APPLY NOW TO GET STARTED

LLC IRA

Perpetual Assets offers the facilitation of LLC IRAs. The LLC IRA is the only way a client can control Cryptocurrency Private Keys in a retirement account, it also allows the client to control delivery and storage options of precious metals. The full cost of the LLC IRA can also be paid with funds from the retirement account.

This checkbook control of the LLC not only allows you to manage Cryptocurrency and Precious Metals, but also allows you to hold liquidity, stocks, bonds, property, and numerous other asset classes.

We do not tell you what to invest in, or control what you invest in. We facilitate the LLC IRA, ensure your compliance, and get the capital to its final destination.

As well as the control, flexibility, and mitigation of risk that go with the LLC IRA, you also get to eliminate all the transaction fees associated with traditional retirement accounts. You are required to pay the annual administrative fees, but that is all. Since all the transactions are made from the LLC which you control, there are no transaction fees for your investments. This also eliminates delays that come with executing transactions through the administrator. In this unpredictable environment when mitigation of risk is a top priority, timing and speed can make all the difference.

HOW IT WORKS

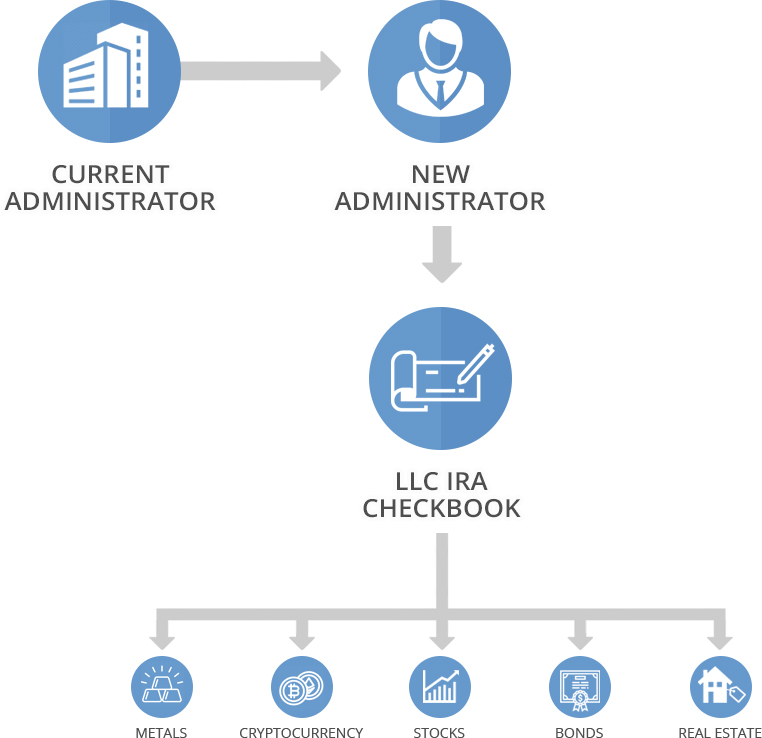

Regardless of the type of current retirement account that you have, we execute the rollover process to a self directed IRA with one of the administrators that we utilize.

While that is taking place we begin the formation of your IRA owned LLC. Once the funds have been transferred to the new administrator and the LLC is completed, the capital is then sent from the administrator to the LLC. From this point the investment decisions become yours. Whether buying Cryptocurrency, Precious Metal, holding liquidity, or investing in land, complete control is yours. There are prohibited transactions (ie, life insurance contracts, collectibles, and self dealing) and we walk you through exactly what they are.

What we do:

This process can be very cumbersome and complicated. We are experts at crafting the proper documents and creating the customized entity and its accounts, all while staying in compliance with IRS, State, and Trustee rules and regulations. Our solution cost is $1997, and can be paid with retirement funds, the turnkey solution includes:

- Assistance in the establishment of the Self-Directed IRA with an IRS approved Trustee

- Establishment of the special purpose LLC (excluding State filing fees)

- Preparation and Filing of the Articles of Organization

- Search of potential company name

- Prepare EIN Filing and obtain EIN number

- Obtain Certificate of Organization from the Secretary of State

- Assistance in formation of an LLC Business Bank Account

- Preparation of a Customized and IRS compliant Operating Agreement

- Assistance in the completion of documents to transfer funds to the LLC